Online shopping has never been easier. Consumers are turning to Buy Now, Pay Later (BNPL) to order things like a new phone or a designer handbag, allowing them to buy items without needing to save up cash or put the purchase on a credit card. But while BNPL offers short-term relief, it raises questions about long-term financial responsibility.

BNPL can lead to overspending, losing track of payments across multiple providers, or otherwise an easy path to racking up debt. The conversation around the benefits and drawbacks of this nascent financial technology continues to grow, and the UK government weighed in last fall, drafting a set of rules to protect consumers.

At Secure Data Recovery, we set out to explore how BNPL is being used across the UK and if it’s truly helping customers or if it’s leading to financial strain. We surveyed Britons to uncover their BNPL habits, their confidence in making payments, and their thoughts on how the government should regulate the bevy of providers. Read on to see how BNPL is shaping the future of shopping across the UK.

Key takeaways

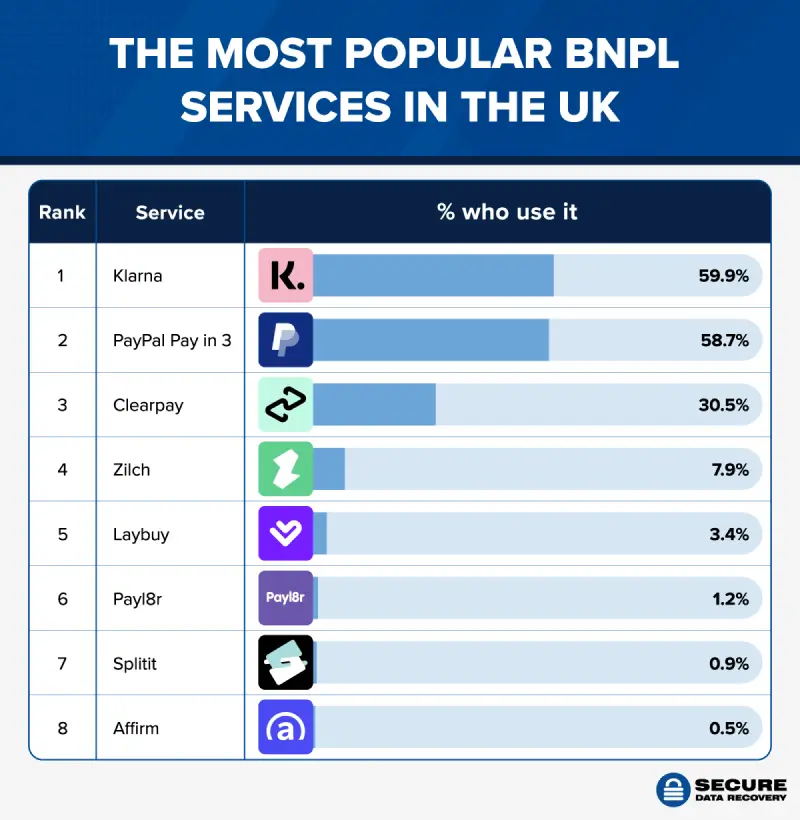

The most popular BNPL services in the UK

Klarna and PayPal in 3 are far and away the two most popular BNPL services across the UK, with each being used by nearly 60% of those who have used a BNPL service. Klarna received votes from 59.9% of respondents who have used a BNPL service, while PayPal Pay in 3 received votes from 58.7%. In a solid, but distant, third is Clearpay, owned by Australian giant Afterpay.

Those three have each been used by 30% or more of the British public with BNPL experience — 22% more than any other service. Affirm, a major BNPL player in the United States, has been used by just 0.5% of Britons, although it got its UK start just this past November.

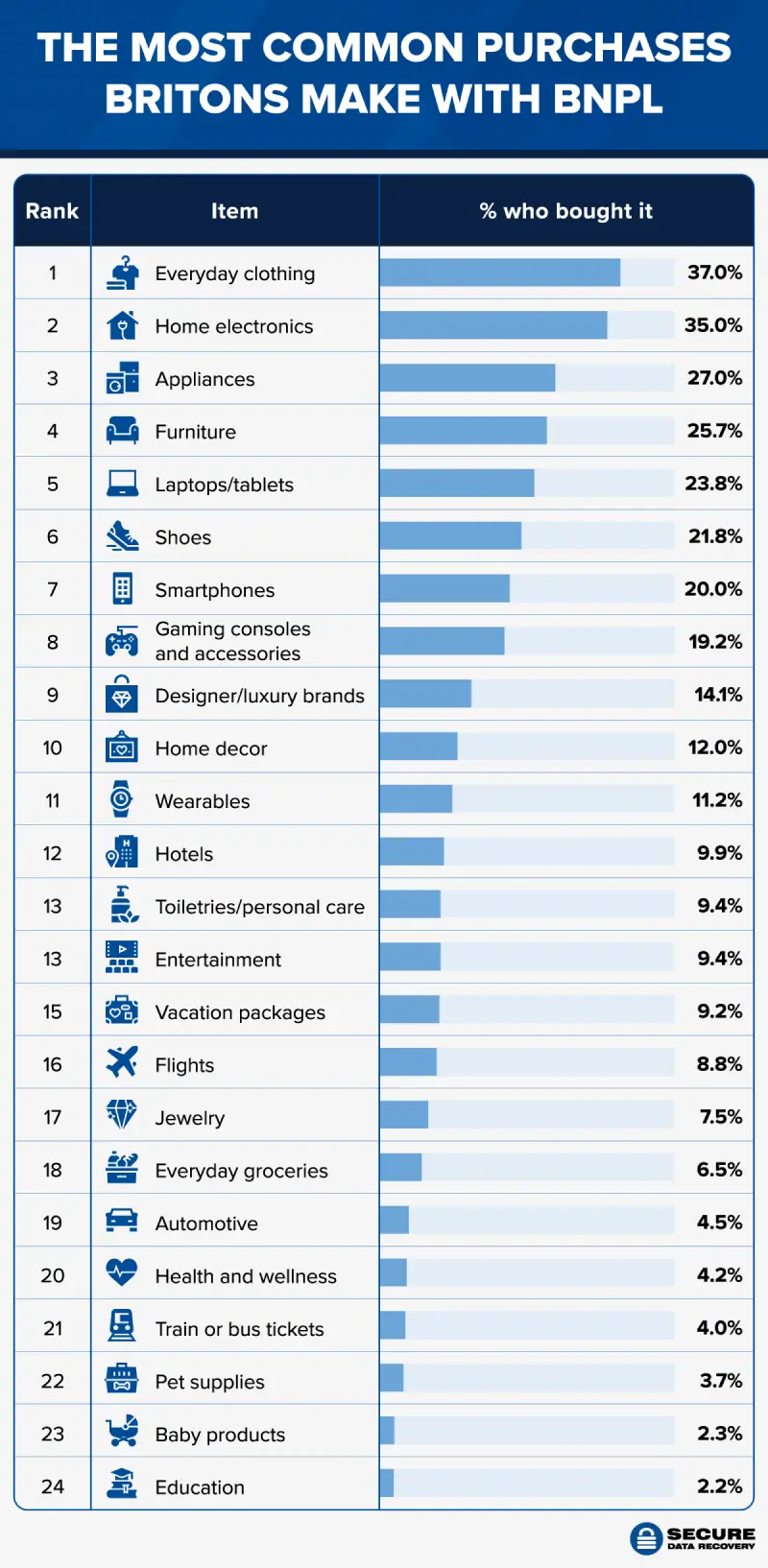

The most common purchases Britons make with BNPL

The most common items purchased with BNPL are everyday clothing, home electronics, and appliances like refrigerators or washing machines. Those items have each been purchased by nearly a third of British BNPL users.

In the next tier sits furniture, laptops/tablets, and shoes — roughly a quarter of British BNPL users have purchased one of those items using BNPL. Rounding out the top 10 most purchased items with BNPL includes smartphones, gaming consoles, designer brand goods, and home decor.

There’s not much revealing data when looking at purchase habits by generation. However, breaking down purchase habits by gender does provide some interesting insights: Of women surveyed, 48% purchase everyday clothing with BNPL (compared to 26% of men), while 41% of men use BNPL to buy home electronics (compared to 30% of women).

BNPL trends in the UK

Of Britons who've used BNPL, 98% say they are "very" or "somewhat" confident in making BNPL payments; however, over 20% admitted to missing at least one payment. In total, over a third of BNPL users have accrued some level of debt via purchases with those services. With that in mind, nearly three-quarters of Britons think that BNPL are good alternatives to credit cards.

It’s also worth noting that BNPL can lead to additional spending — 66% say they're willing to spend more if there's a BNPL option, and over 80% of respondents said that BNPL services encourage overspending. Meanwhile, 58% spend over £100 on a single purchase using BNPL

When it comes to government regulation, almost 80% of Britons believe the government should regulate BNPL services; however, just 70% of Gen Zers think so. Keeping with the Gen Z theme, that generation is the most on-the-go: Nearly half of Gen Zers primarily use a mobile app to access BNPL, vastly outranking other generations.

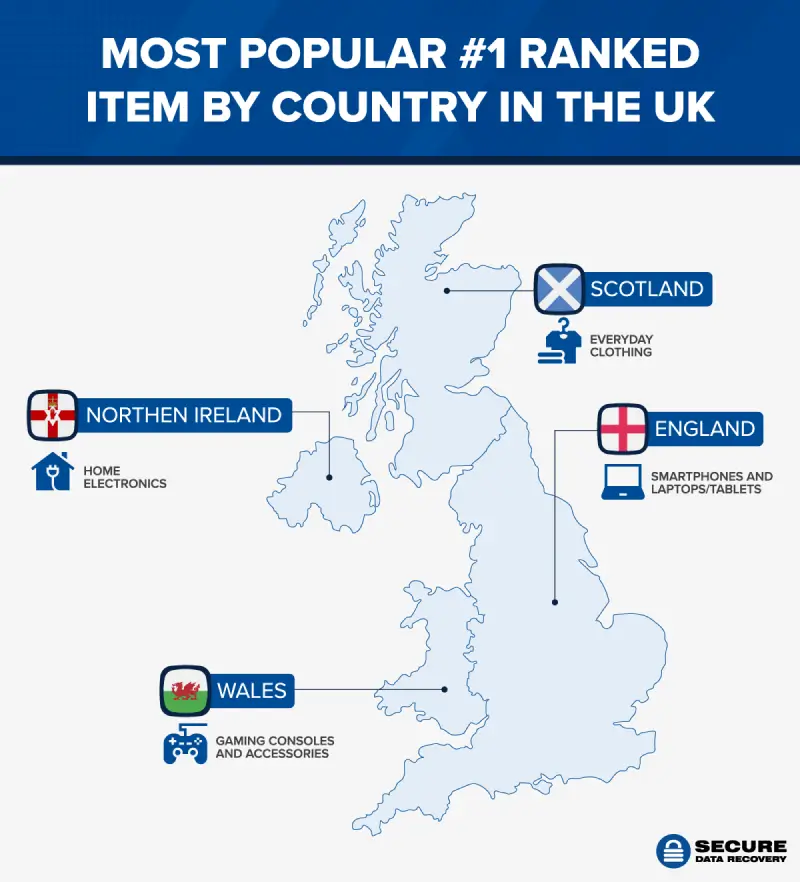

Finally, let’s look at the United Kingdom’s four countries and the most popularly purchased item with BNPL that isn’t popular elsewhere.

England ranks top for using BNPL to purchase smartphones and laptops/tables. Scotland, meanwhile, purchases everyday clothing more often than the other countries. Welsh residents lean toward purchasing gaming consoles and electronics. And lastly, Northern Ireland's most popular BNPL items are home electric goods, such as televisions or speakers.

Conclusion

In today’s digital age, making purchases has never been easier. With just a few taps on your smartphone, you can split payments and shop on the go. However, just as we piece out payments to protect our finances, it’s crucial to protect the digital devices we use for these transactions.

At Secure Data Recovery, we understand your devices contain more than just shopping apps: They hold your payment history, account information, and financial planning data. When these devices fail, you need more than just a replacement — you need your data back.

Our team of data recovery experts operates across the UK with a 96% success rate in recovering data from all types of devices. Whether your smartphone takes a swim or your laptop suffers a critical failure, we’re here to ensure your digital life stays intact.

Methodology

In this study, we set out to learn Britons' thoughts on Buy Now, Pay Later (BNPL) services. We surveyed 1,530 individuals across the United Kingdom, asking them a range of questions related to BNPL. These questions included which services they'd used, how frequently they use BNPL services, items commonly purchased, and thoughts on government regulation of BNPL.